45l tax credit certification

Code 45L - New energy efficient home credit. WHO CAN CLAIM THE 45L TAX CREDIT.

Tax Credit Inspections Skyetec

The 45L credit is one of many benefits of the HERS rating.

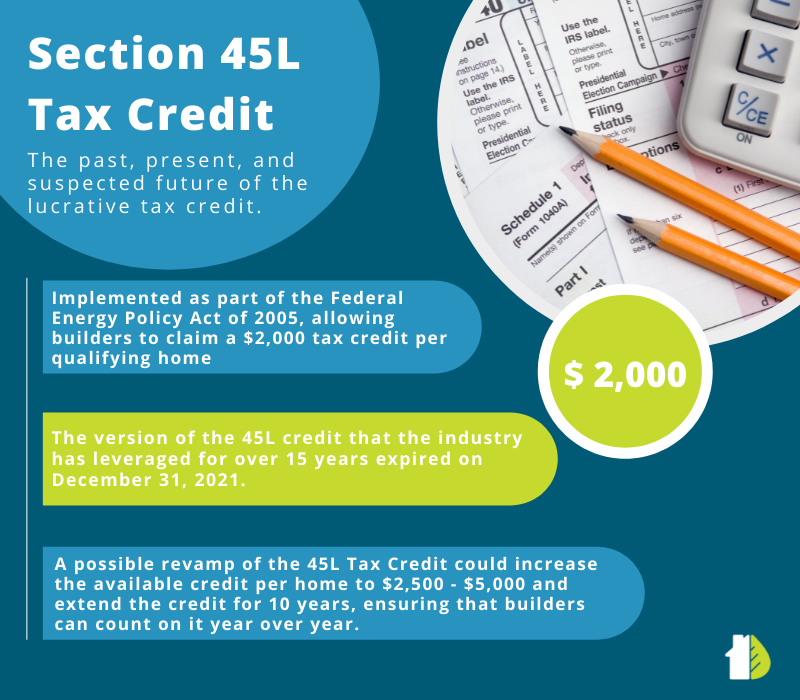

. Rutgers Recreation - Sonny Werblin Rec Center 656 Bartholomew Rd Piscataway NJ 08854 US Date and Time. The 45L Tax Credit is a Federal Tax Credit worth 2000 per dwelling unit that rewards multifamily developers investors and homebuilders that develop energy efficient. Initial certification requires 21 credits or seven courses.

Browse reviews directions phone numbers and more info on Tax Credits LLC. November 12 2022 - 900am - 600pm EDT Description. The leader in 45L Tax Credit certification support service including EnergyPro 45L software Raters services and free 45L plan reviews.

They are ESLM 578 Theory and Practice of. 45L Energy Efficient Tax Credits. Acquired by a person from such eligible contractor for use as a residence during the taxable year.

They are ESLM 578 Theory and Practice of Teaching ESL ESLM 587 Curriculum and Methods for Multilingual Populations ESLM 525. The 45L tax credit is a home federal tax credit available to new construction multifamily and single-family projects that meet energy-efficiency building standards. Business profile of Tax Credits LLC located at 45 Knightsbridge Road 22 Piscataway NJ 08854.

Builders owners and developers of residential homes and apartment buildings have the opportunity to earn tax credits for energy efficiency if their. The leader in 45L Tax Credit certification support service including EnergyPro 45L software Raters services and free 45L plan reviews. The 45L Tax certificate which.

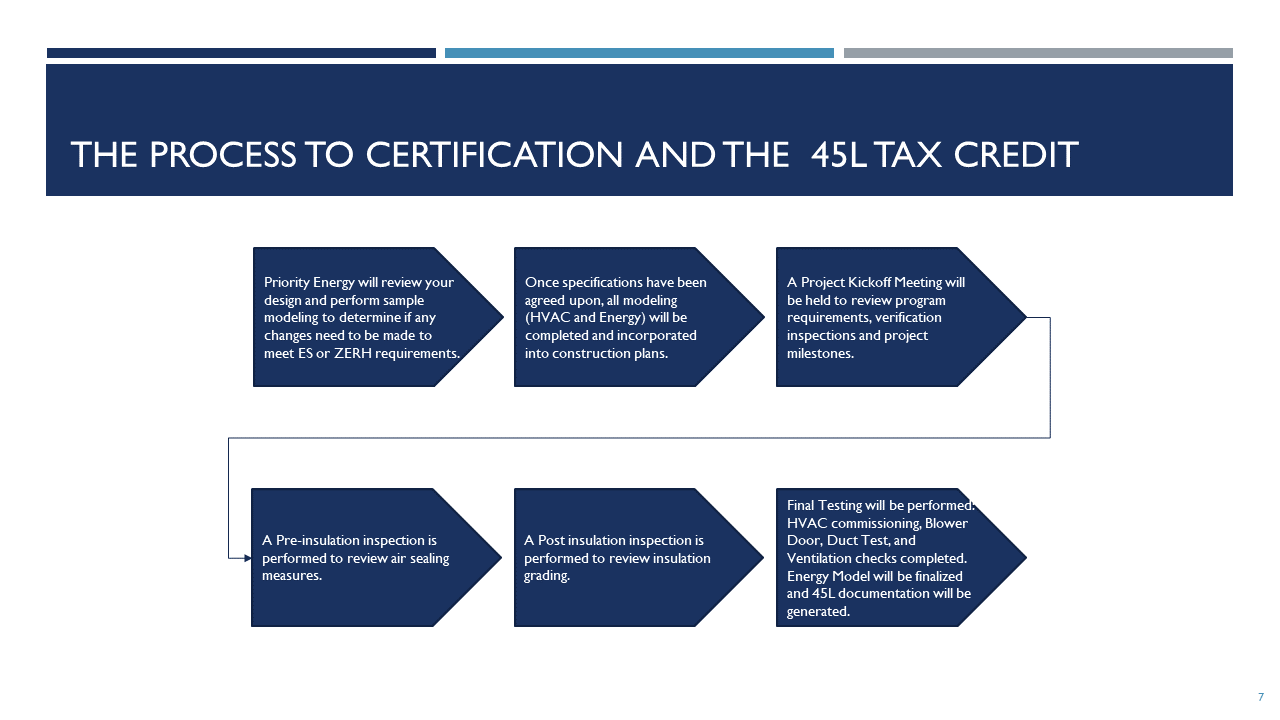

The certificate holder can receive a 2000 tax credit per qualified single family home and multi-family unit built and sold before 01012022. A contractor must obtain the certification required under 45Lc1 with respect to a dwelling unit other than a manufactured home from an eligible certifier before claiming the energy. The basis for developing and supporting the 45L tax credit is a detailed energy analysis and certification that must be signed off by a qualified third-party or as the IRS defines them an.

Complaint against Tax Credits LLC. Detailed energy analysis documents and reports can be provided including Energy Star certification. Once your 45L certification is complete your will receive a full certification package that contains all the necessary certifications and documentation youll need to.

View complaint history and get your dispute resolved quickly.

Federal Energy Tax Credits 45l Are Back Ducttesters Inc

45l Tax Credit Single Family Guide For More Money Back Southern Energy Management

The 2 000 45l Efficiency Tax Credit What You Need To Know Attainable Home

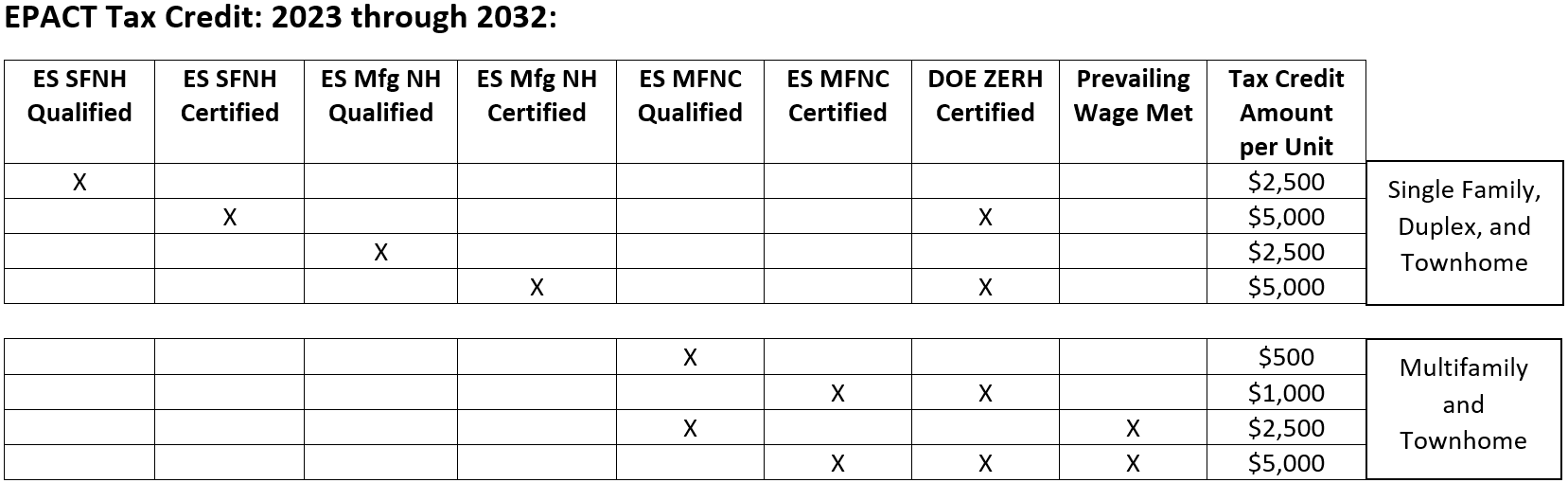

Energysmart Institute How Does The Inflation Reduction Act Impact The 45l Energy Efficiency Tax Credit For New Construction Of Homes And Apartments

Is It Too Late To Take Advantage Of The Section 45l Tax Credit Cost Segregation Authority

Everything You Need To Know About 45l Tax Credit Mom And More

45l Energy Efficient Home Tax Credit Extended For 2021 By Covid Relief Bill Green Building Law Update

Contracts Can Claim The 45l Tax Credit Tri Merit

45l Federal Builder Tax Credit

Next Up On 45l Federal Tax Credit Ducttesters Inc

The 45l Tax Credit For Builders Priority Energy

45l Tax Credit Tax Credit For Energy Efficient Homes Bit Rebels

Section 45l Tax Credit Case Study Apollo Energies Inc

The Inflation Reduction Act Of 2022 Provides Significant Changes To The 45l Energy Efficient Home Credit Ics Tax Llc

45l Tax Credit Multifamily Guide For More Money Back Southern Energy Management

The 179d 45l Energy Tax Credits Offer Cash Flow Elb Consulting

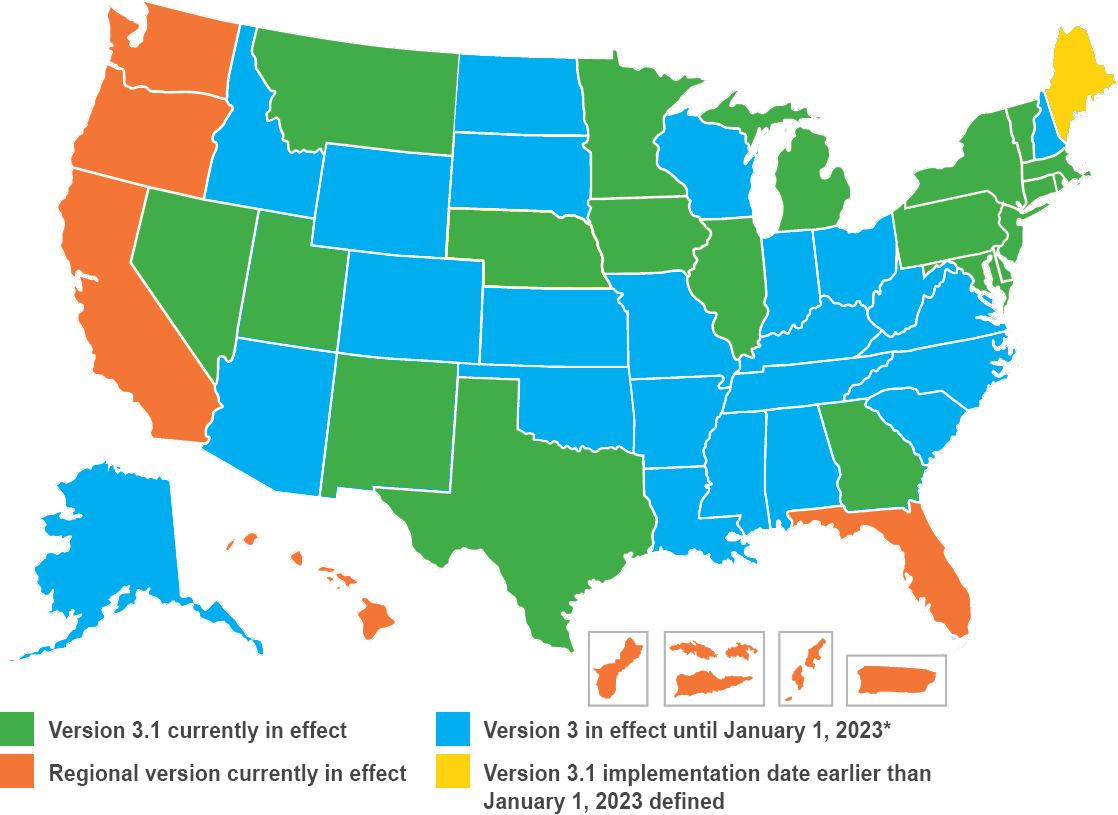

Residential New Construction Program Requirements Energy Star